SEC Improves Access to Capital Markets

By: Chris Dargie, Joel Shaw and Daniel McCue

In Brief

On November 2, 2020, the Securities and Exchange Commission (the “SEC”) approved several important amendments to the private offering framework under the Securities Act of 1933, as amended (the “Securities Act”).

The amendments, entitled “Facilitating Capital Formation and Expanding Investment Opportunities by Improving Access to Capital in Private Markets,” will be effective 60 days after publication in the Federal Register, except for the amendments pertaining to Regulation Crowdfunding, which will be effective upon publication in the Federal Register. Certain key aspects of the amendments are summarized below.

General Solicitation

Subject to various conditions, the new amendments specifically allow an issuer to test-the-waters for an exempt offering prior to determining which exemption it will rely upon. It is important to note that the new amendments do not relieve an issuer from complying with general solicitation prohibitions in any registration exemption upon which it subsequently seeks to rely if it tests the waters in a way that constitutes a general solicitation under federal securities laws.

Subject to various conditions, the new amendments also specifically allow for demo day communications at events sponsored by institutions of higher education, state and local governments, nonprofits, angel investor groups, incubators, and accelerators.

Finally, the new amendments permit an issuer to test the waters orally or in writing under Regulation Crowdfunding before filing Form C, the required compliance document, with the SEC.

Offering and Investment Limits

- Regulation A: The amendments raise the maximum offering amount from $50 million to $75 million for Tier 2 initial offerings and from $15 million to $22.5 million for secondary sales.

- Regulation Crowdfunding: The amendments raise the maximum offering amount from $1.07 million to $5 million. Notably, investment limits no longer apply to accredited investors, and non-accredited investors are allowed to rely on the greater of their annual income or net worth when calculating their investment limit.

- Regulation D: The amendments raise the maximum offering amount in Rule 504 offerings from $5 million to $10 million.

Integration

The amendments provide for four new non-exclusive safe harbors to avoid integration of private offerings:

- Offerings made more than 30 days apart (subject to special conditions when an exempt offering for which general solicitation is permitted is followed by an exempt offering for which general solicitation is not permitted).

- Offerings under Rule 701, pursuant to employee benefit plans, or in compliance with Regulation S.

- Certain offerings preceding public offerings.

- Offerings made in reliance upon an exemption where general solicitation is permitted if all other offerings of the issuer have been terminated or completed.

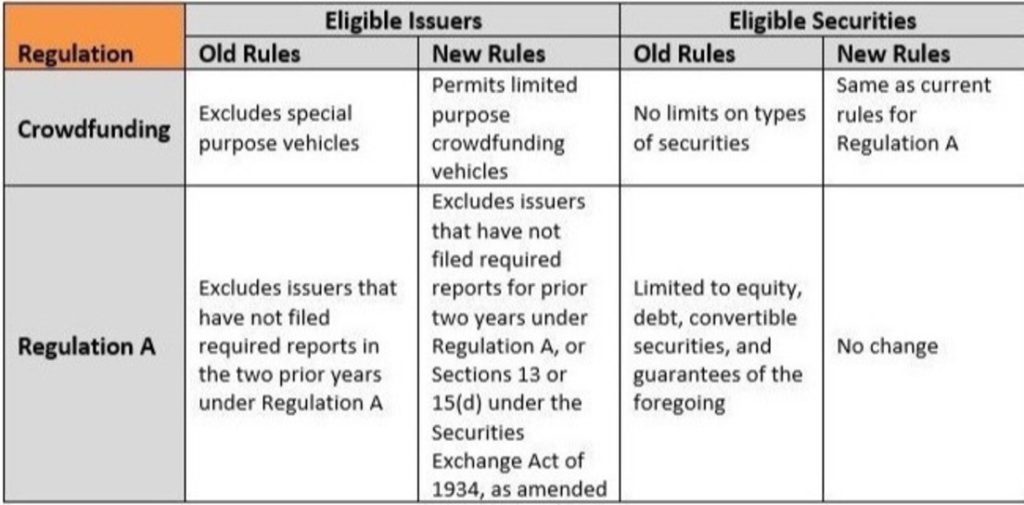

Eligibility Under Regulation Crowdfunding and Regulation A

The amendments make the following changes to Regulation Crowdfunding and Regulation A:

Disclosure Requirements in Rule 506(b) Offerings

The amendments change issuers’ financial disclosure requirements pertaining to sophisticated investors in Rule 506(b) offerings to align with the disclosure requirements of Regulation A. Specifically, for Rule 506(b) offerings up to $20 million, issuers are no longer required to provide audited financial statements to sophisticated investors (unless an audit has already been obtained for another purpose), and for Rule 506(b) offerings greater than $20 million, issuers are generally required to provide audited financial statements to sophisticated investors.

Rule 506(c) Accredited Investor Verification

The amendments add a new accreditation verification method to allow an issuer to establish that an investor, initially verified as accredited by the issuer, remains accredited as of the time of a subsequent sale. The new method requires that:

- The investor provide a written representation that the investor is still accredited, and

- The issuer is not aware of information to the contrary.

In all cases, this new verification method is subject to a five-year time limit after the issuer’s initial verification of accredited investor status.

Bad Actor Disqualifications

The amendments align the bad actor lookback period of Regulations D, A, and Crowdfunding.

Bottom Line

The new amendments are expansive, and this summary is not a complete inventory of all changes to the private offering framework under the Securities Act. If you would like additional information about the amendments or about securities matters in general, the Bernstein Shur Private Capital team is pleased to speak with you. Learn more about our Private Capital Practice Group.